Life Insurance Corporation or LIC offers a savings insurance policy that is known as the LIC Dhan Rekha plan. This policy comprises numerous advantages. To purchase the Dhan Rekha policy one needs to stick to simple not-so-complicated steps be it offline or online.

Eligibility for LIC Dhan Rekha Plan

However, to purchase this policy, one needs to meet the requirements of certain eligibility criteria. The criteria are mentioned below:-

- The demanded minimum age during the time of entry may range between 90 days and 8 years as well. The policy term will decide the required minimum age of the individual.

- The maximum age during the time of entry ranges somewhere between 35 years and 55 years. The policy term will decide the required minimum age of the individual.

- The assured sum must be Rs. 2 lakh minimum.

- There is no upper limit to the sum that is to be assured.

The policy term for Dhan Rekha

Three different policy terms are offered and they are mentioned below:-

20 years:- When one opts for a 20-year policy term, the required premium should be paid for 10 years!

30 years:- When one opts for a 30-year policy term, the required premium should be paid for 15 years!

40 years:- When one opts for a 40-year policy, the required premium should be paid for 20 years!

Benefits under LIC Dhan Rekhaa Plan

The said benefits of the LIC Dhan Rekha are as follows:-

Death benefit:-

- If the life-assured person passes away during the policy period, the death benefit will be given to the life assured’s Along with this, the guaranteed contributions accumulated up until the time of the death will also get reimbursed.

- The beneficiaries surely qualify for additions along with 125% of the principal amount!

- The entire guaranteed at death will be equal to 125% of the basic sum assured.

Survival benefit:-

Under the case where the insurance is in effect along with the life guaranteed endures for each of the predefined intervals in the time of the policy period, a certain fixed percentage of the basic assured sum will surely be paid.

Maturity benefit:-

If the life assured survives the specific maturation date while the insurance is still in effect, the ‘Principal amount on maturity’ along with the accumulated will be paying the guaranteed supplements. Here, the basic amount will be equivalent to the ‘principal amount on maturity’.

Tax benefit:-

According to Articles 10(10D) as well as the 80C of the Income Tax Act of the year 1961, the tax concessions of both the premium as well as the benefit will sum up. A solicited piece of advice here would be to consult either a financial consultant or a tax expert to get more insight on the income tax benefits.

LIC Dhan Rekha Plan Calculator

Through the LIC Dhan Rekha Plan calculator, one will be able to calculate the money back amount, premium, and maturity amount concerning the age of the policyholder besides his policy term and the sum assured. It also shows the lic dhan rekha plan premium chart through which one will be able to see the premium amount against their desired sum assured.

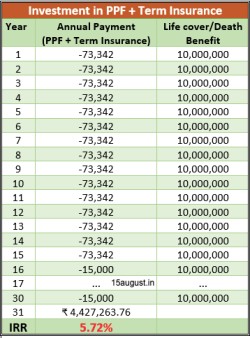

Explanation of LIC Dhan Rekha Calculator – Mr.A buys the LIC Dhan Rekha Plan for 30 years policy term, where he needs to pay a premium amount for 15 years. For Rs.10,00,000 (10 lac), Mr.A needs to pay Rs.73,342 for 15 years. Mr. A in return will receive 11lac of life cover. At the end of the policy, Mr. A will receive Rs. 10 Lac of the Sum Assured and Rs.13 lac of Guaranteed Additions.

So, in total Mr.A will receive Rs.23 Lac of guaranteed maturity benefit.

Certain factors are needed to be considered for LIC Dhan Rekha Maturity Calculator and they are as follows:-

- Policy term.

- Age.

- Type of premium payment.

- Assured sum.

- Premium paying term.

Buying LIC Dhan Rekha Online

The following are the steps that need to be followed to buy LIC Dhan Rekha online:-

- Visit the official website of LIC which is Licindia.in.

- Tap on ‘buy a policy online’.

- Select the option ‘LIC’s Dhan Rekha’ and then tap on ‘CLICK TO BUY ONLINE’.

- Fill in all the asked credentials like the name, date of birth, email address, mobile number, and such.

- You will receive an OTP. Enter it and then proceed.

- After successful submission, make double sure that all the details are correct and then proceed to do the payment.

- Finish the process by paying through a credit card or Net banking.

For non-medical cases, it will be completed depending on the submitted documents. In case of medical cases, the relevant service provider will contact after which the LIC will underwrite the case. After a significant decision is reached, a policy number will be allotted by the LIC and the necessary details will be sent on the registered email ID. A copy of the policy will be both mailed as well as sent by post.

Conclusion

Thus, this is all the information that is there to know about the Dhan Rekha LIC calculator. The LIC Dhan Rekha is a non-participating, non-linked, life insurance plan that is available with payment of limited premium payment terms and single premium terms of 10 years, 15 years as well as 20 years. now, that you have all the information that is needed to know about this plan, you are all set to invest in it.

Also Read:-

- Statue of Unity Ticket Prices

- Char Dham Yatra Package

- MAHSR Bullet Train’s C2 Tunnel Contract

- IPL Purple Cap

- IPL Orange Cap