Here we are providing you all Features, Benefits and Premium Plan of LIC Jeevan Akshya 6 Retirement Plan.Its an immediate annuity plan means you can buy LIC Jeevan Akshay with paying any lumsum amount.

Benefits of LIC Jeevan Akshay 6 – Features of Jeevan Akshay

Also, there is special benefit that you will immediately gets pension without delay just after you buy policy. You can choose options like Monthly, quarterly, half yearly or yearly for pension payment in LIC Jeevan Akshay plan.

Features of LIC Jeevan Akshay 6 Plan

Entry Age – Minimum age where you can join is 30 years and maximum age is 85 years decided to join this plan.<

Minimum purchase price :- You need to buy Rs.1lac of policy (retirement plan) if you buy offline, and Rs.1.5 lac if you buy online. There is no upper limit.

As said above Payment of Annuity or Pension will be start immediately after buying policy.

How much pension you will get?

The pension amount depends on the amount of insurance you buy, but to give you example, lets take example of Rs1 lac. For example, you buy Rs.1 lac of Jeevan Akshay plan (as its a minimum amount). Than you can get monthly Rs.500 (or Rs.1000 per quarterly or Rs.3000 per year).

You will get this pension for 5,10,15, or 20 years, till the annuitant is alive.

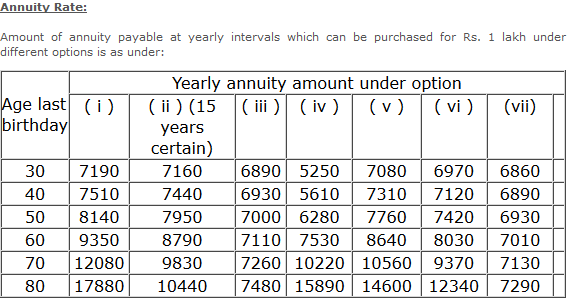

How much Annuity Rate will be provided?

Amount of annuity payable at yearly intervals which can be purchased for Rs. 1 lakh under different options is as under;

Also you will be provided Incentives if you buy Rs.2.5 lac or above plan. You will receive rebate of 1% by way of increase in the annuity rate.

Other benefits of LIC Jeevan Akshay plan

In case of death of the person, pension will be depending on the option choose for pension. There is no maturity benefit provided.

You can get income tax benefit via 80C though pension received under this plan is taxable.

How to buy LIC Jeevan akshay plan?

To buy this plan, you need to decide the amount you want to buy this plan (As the pension amount decided on the plan amount). As said above, you will get Rs.500 of pension monthly if you buy Rs.1 lac of plan.

Than after choose the annuity option (there are 7 options available, which you can choose). Than you can buy this plan from online LIC site or via from LIC agents.

Documents needed to buy this plan

In documents, you will need to provide

- Address proof (Pan Card/ Aadhar Card)

- Age proof (Birth Certificate)

- Duly application form

- And Medical Report (if demanded).

You can also check out the features, benefits of Jeevan Akshay plan by below slideshow;

So, did you like LIC Jeevan Akshay Plan? Share your views, feedback and queries on below comment box.

Source :- https://licindia.in/Products/Pension-Plans/LIC-s-Jeevan-Akshay-VII

Also Read:-

- Benefits of LIC Jeevan Labh Policy [Plan Table 830]

- LIC vs Mutual Funds – Best Tax Saving Option

- Benefits of LIC Jeevan Pragati Plan No. 838

- Review of LIC Jeevan Shikhar [Table No 837]