LIC Kanyadan policy is one of the best financial coverages as it comes with comparatively less premium. Through this plan, the future expenses of the daughter for their marriage and education will be covered up as this policy will hence act as a backup plan.

When it comes to the discussion of an Indian girl, the very first concern that strikes the mind is about her education and marriage expenditure, thus the LIC Kanyadan policy acts as a boon to the family of the girl child because it will help them financially.

In terms of Kanyadan policy LIC, the government offers one of many benefits that is offered to uplift and encourage the daughters of India so that they can achieve what they have already aspired for. Through this policy, a pure endowment plan will be enjoyed by the daughters as it will cover against the risk.

The policy is designed for people who can’t afford to spend money on their daughter’s education which is then followed by the marriage. Thus, the special consideration of the future of the daughter has been initiated which is the actual motive of introducing and implementing this scheme.

Highlights of the LIC Kanyadan Policy

- LIC Kanyadan policy is one of LIC best policy offers.

- Optimum security for life risk with a fixed time limit up to three years before the maturity date of the LIC premium.

- The life assured will get a total lump sum cost as soon as it hits maturity.

- LIC policy premium waiver facility is given only after the definite death of the father.

- In the case of accidental death, ten lakhs is paid.

- In the case of non-accidental or natural demise, five lakhs is paid.

- Rs. 50,000 is paid every year until maturity is reached.

- The entire maturity value will be available at the maturity.

- The LIC policy is availed to the NRIs where there is no need to come to India.

- The features of LIC Kanyadan policy and LIC Lakshya Policy are somewhat similar.

Further information regarding the LIC Kanyadan policy is available on their official website

Information about LIC Kanyadan Policy

The following are the information that should be known concerning LIC Kanyadan policy:-

- Exclusions: The policy will not be implemented in case the policyholder commits suicide in the initial twelve months

- Freelook period: Once the LIC Kanyadan policy has been implemented, a free look of fifteen days from the date of commencement of the policy is initiated. If the policyholder does not like the policy, then he or she shall revoke themselves from the policy.

- The grace period: A 30-day grace period of annual, quarterly, or half-yearly payments is implemented after the initiation of the policy. In terms of the grace period, no kind of penalty or late fees are imposed on the policyholder. In the case, the premium remains unpaid even after the grace period, the policy will be terminated without any announced intimations.

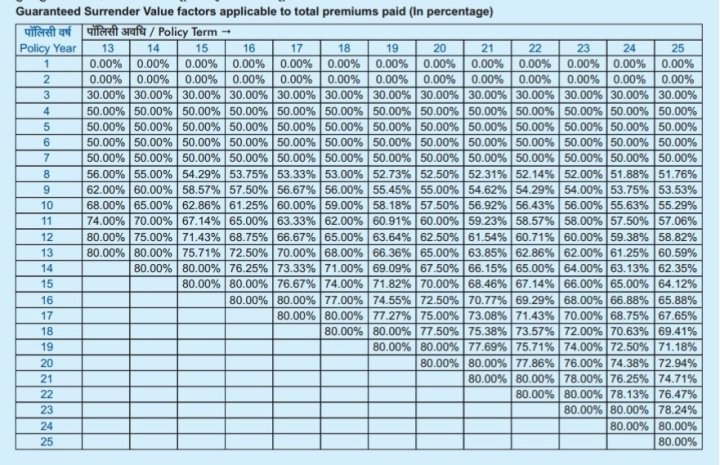

- Surrender value: If the payments are regularly paid after 3 honest years, the surrender period shall be strictly paid just before surrendering the LIC Kanyadan policy. The entire percentage of premiums that excludes the rider premium implies the guaranteed surrender value. This entirely depends on the surrender year as well as the respective policy terms.

Terms and conditions of Kanyadan Policy

The following are the terms and conditions of the LIC Kanyadan policy:

- Minimum Basic Sum assured– 100,000

- Maximum Basic Sum assured– No limit

- Policy term– 13-25 years

- Premium paying term– policy term- 3 years

- Minimum age at entry– 18 (including the last birthday)

- Maximum age at entry– 65 (including the nearer birthday)

- Maximum maturity age– 65 (including the nearer birthday)

- Daughter’s minimum age– 1 year.

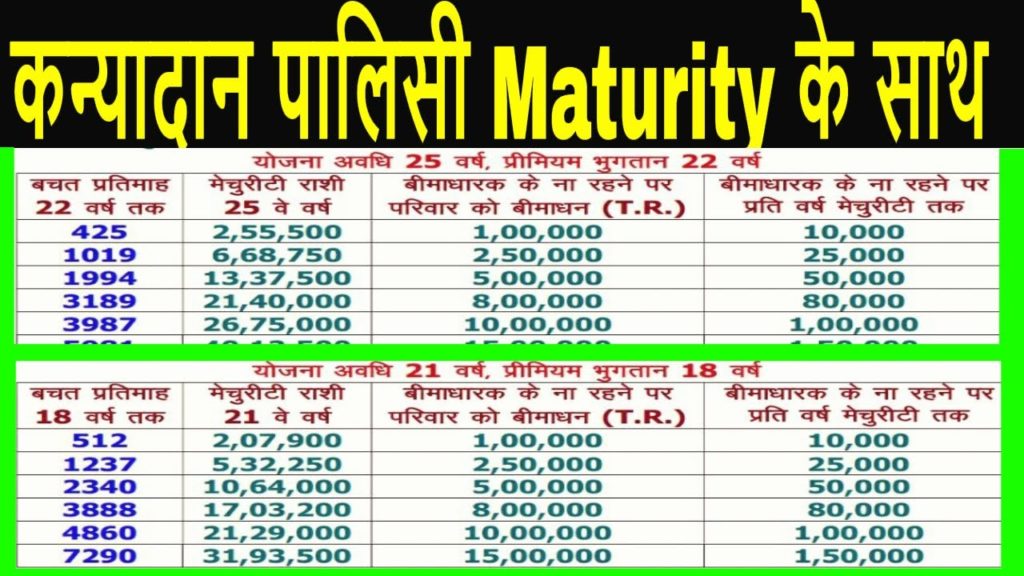

LIC Kanyadan policy premium chart

The following is the LIC Kanyadan policy premium chart for understanding the concept better:

| Criteria | LIC Kanyadan policy |

| Age eligibility | Daughter age (at least)- 1 year

Father’s age – 50 years |

| Nationality eligibility | NRIs are eligible |

| Account holder | Father of girl child |

| Sum Assured limit | Minimum- 1 lakh

Maximum- no limit |

| Payment limit | No limit |

| Account maturity tenure | 13 years to 25 years |

| Loan facility | After 3 consecutive years of making the payment, the loan can be availed |

| Payment term | Under the policy term, it is three years |

| Scheme type | Not launched by LIC but it is based on Jeevan Lakshya |

| In terms of death | In case, the father encounters death, the premium will be waived |

| Offered compensation | Under natural demise- 5 lakhs of immediate payment will be done

Under an accidental demise- 10 lakhs of immediate payment will be done Conducting suicide within the 12 months of initiating the policy- the corporation pays 80% of the premiums besides the tax value and the surrender value |

LIC Kanyadan policy calculator

The LIC Kanyadan policy calculator is simple and can be figured out in easy steps. Under this policy, the person shall have to deposit Rs. 130 every day which means in a year, Rs. 47, 450 shall be deposited. Here, in this case, the premiums will be effectively paid for less than 3 years of the respective period for which the Kanyadan policy is in effect.

Making the daughter financially secure is the main objective of this policy. Irrespective of the fact that LIC does not offer this kind of policy in its name, LIC Kanyadan policy is becoming quite renowned nowadays. This very policy is widely based on the LIC Jeevan Lakshya policy. The main reason why this policy is becoming famous among the buyers is that it focuses majorly on the name of the girl child. This pure endowment policy, LIC Kanyadan policy provides great saving options which itself justifies why this policy is one of the best policies you can gift your daughter.

Also Read :-

- Review of LIC Jeevan Shikhar [Table No 837]

- Benefits LIC Jeevan Lakshya – Premium Amount

- Benefits of LIC Jeevan Pragati Plan No. 838

- LIC Jeevan Tarun Policy Table 832 Review

- LIC Jeevan Sangam – Features and Benefits

- Official Website