Difference between Direct Plans Vs Regular Plans of Mutual funds

Basic Difference between Direct Plans and Regular plans of Mutual funds

So, here is the basic difference between direct plans and Regular plans of mutual funds;

Regular plans: – In regular plans, mutual fund house or Assets under Management (AMC) will charge you with trail fees, distributor expense or transaction charges.

Direct Plans: – In Direct Plans, you will be dealing with directly to Assets under Management, so you will be not charged with those other charges. Direct means direct, no intermediate, no middle man, direct deal with MF houses.

Why we should always invest in Direct Plans?

Apart from that, there is difference in return given by direct plan and Regular plan. Lets check out some practical examples, where you will see the difference between regular and direct plans.

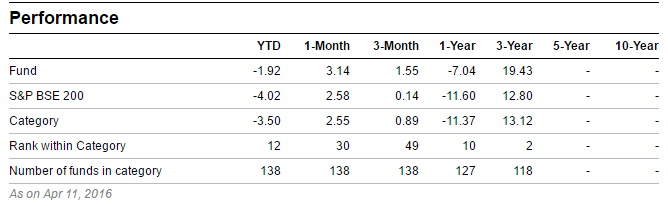

1. Birla Sun Life Frontline Equity Fund :- This plan is lunched in 2002 and its current NAV is Rs.155.23. Below is difference between Regular plan and direct plan of Birla Sun Life Frontline Equity Fund.

Birla Sun Life Frontline Equity Fund – Regular plan

Birla Sun Life Frontline Equity Fund – Direct Plan

As you can see, at last 3 year Birla Sun Life Frontline Equity Fund gives 18.38% of return in regular plan where 19.43% in direct plan. It is same plan, same fund manager, everything is same, just difference of direct and regular gives 1.05% extra return.

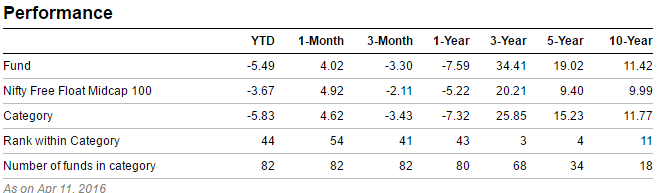

2. UTI Mid Cap Fund:- UTI Mid cap fund was launched in 2013 and current NAV is Rs.77.77. At 3 years of return, UTI Mid cap fund regular plan gives 34.41% of return while direct plan of UTI Mid cap gives 35.36% of return. Which means direct plan gives 0.95% of extra return.

– UTI Mid Cap Fund-Regular Plan

– UTI Mid Cap Fund – Direct Plan

As you can see from above two examples, direct mutual fund plans give 1% return on each scheme (or we can say atlest gives more return than regular plan). When you are buying same thing, for same price, why settle for less return? Why can’t we go for extra investment return just by opting out direct plans than regular plans.

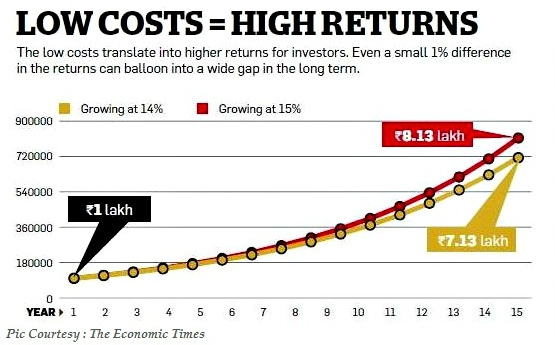

What is in 1%?

You may find someone who will give excuse like what is in 1% extra. Well, 1% extra can gives you lakhs of amount. Yes. If you invest in regular mutual fund which gives you 14% return and direct plan which gives you 15% (1% extra return ) than in 15 years you gain 1 lakh rupees extra for 1 lakh of investment. Do check out below mentioned Economic times graph. Which explains direct plans vs regular plan difference.

Hope this guide will help you to invest better and to earn better. Always invest in Direct plans of mutual fund.

Also Read:-