Incometax.sparshindia.com – You did not received your PAN Card after applying online? here is Guide you need to follow to complain about “Pan Card Not Received“. One reader has asked me that he made online application for PAN card, but he has not received his pan card, even after several try to find the status of Pan card. Well, here is an answer for it;

PAN Card Not Received – What to do? – Incometaxindia.gov.in

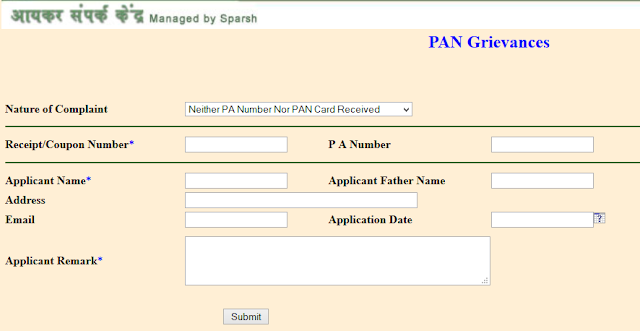

To get Pan card and to register complaint of Pan card Not Received, you need to visit NSDL.com, its a new portal designed by Income Tax Department (PAN Grievances). On this portal you need to follow below steps;

Step 1. Go to This link https://tin.tin.nsdl.com/pantan/StatusTrack.html now.

Step 2. Select “Nature of Complaint” option from drop down, (you can register complain for PA Number not received, Returned Undelivered, Name, Photo, Father’s Name Mismatch on pan card, or any other issue, like below image).

Step 3. Enter Receipt/Coupon Number you received at the time of application for Pan Card.

Step 4. Fill Applicant’s Name, Address, email address, Date of birth, Phone no with STD code (or mobile number).

Step 5. Write detail about how and what happen to your Pan Card (when you applied and what happen, why you not received or any other remark) in the box of Applicant Remark.

Step 6. select the agency whether it is NSDL or UTIISL.

Step 7. Submit.

That’s It. Now Income Tax Department will soon come back to you, reply at your email address, phone number or postal address. And will give you detail about your pan card.

Sometimes it happens that postal people or because of human error, it may possible that you may not receive Pan card on time. So, here you can make attention of Govt officials about your issue.

Note :- Do not make application for multiple pan card, It is illegal to have more then one Pan card. In case you lost your pan card, follow this link to get duplicate pan card.

Visit here, If you want to apply for Fresh New Pan Card Online.

Why you must have Pan Card?

There are lots of use of Pan card, at many places, you will need pan card. For doing any big amount transactions, bank will ask you for Pan Number. Government of india has made compulsory to file Income Tax Return, in that case, to file income tax return, you will need Pan card.

Hope this will help you to get your Pan card, Thanks for reading, comment below your query.

Also Read:-

- List of 20 Types of Taxes in India

- How to Get Duplicate Birth Certificate? – Detail Guide

- Top 5 Websites to Earn Money Online – Start Earning Now!

- Kisan Vikas Patra Scheme – How to Apply