The biggest single-day gain in eight months for BSC (Bombay Stock Exchange) index surged around 700 points. The biggest nationalized banks such as Union Bank of India and United Bank of India cut their BLR (Base Lending Rates) on the same day. Moreover, the newspapers passed a vital headline about “RBI cuts key interest rate.” What is the key interest or repo rate? Let’s know more about that in this article.

8 Benefits of RBI Repo Rate cut to Loan Borrowers

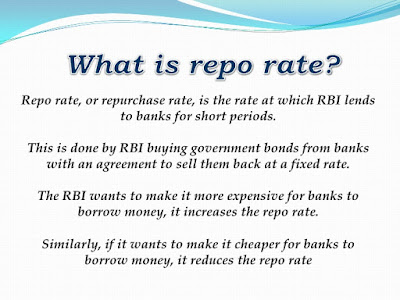

First of all, you must know what is Repo Rate?

When we take a loan from a bank, the bank charges a definite interest rate on a particular loan. It is known as the cost of credit. Likewise, when banks require money, they approach to Reserve Bank of India. The rate at which banks borrow money from the Reserve Bank of India by retailing their surplus government securities to the RBI is called “Repo Rate”. The full form of Repo Rate is Repurchase Rate.

For example, If the REPO rate is 8% and the bank takes a loan of Rs. 1000 from the Reserve Bank of India, then they will pay Rs 80 to the RBI. Moreover, the current repo rate is 7.75% as of January 2021.

The Reserve Bank of India has cut Repo Rate by 50 basis points 0.25% on 30th September 2021. The RBI governor has surprisingly cut the interest rates for the first time in almost 2 years. So, if the repo rate is low, banks have to pay lower interest amounts on their loan. Ultimately, it helps us to pay lower interest rates on the loans taken from banks.

Benefits of RBI Repo Rate cut:-

The RBI Repo Rate cut will affect deposit rates, lending rates, the money supply in the economy, economic growth and buying power of customers. The state-run lenders United Bank of India and Union Bank of India were the first who cut their Base Lending Rate by 0.25% to 10%. In addition, the state bank of India has previously cut its Deposit Rates indicating the plunging trend of the home loan or lending interest rates.

Here are the benefits or impacts of the RBI Repo Rate cut.

1. It doesn’t mean that the RBI Repo Rate Cut will benefit the borrowers immediately. The banker must lower the Base Lending Rate first. If your bank does so, then only your loan EMI will be reduced.

2. These rate cuts will not affect Fixed Rate Home Loans or Fixed Rate Consumer Loans.

3. The current bank customers who have taken loans can notice their Loan Tenures or Loan EMIs reducing. However, by default, the banks lower the loan tenure instead of loan EMI. So, your monthly EMI instalment amount persists the same. In addition, the rate cut will make a considerable difference if the enduring loan term or tenure is very long.

4. If you don’t know about your EMI status whether it is reduced or not, you must contact your banker or lender to rearrange the term and conditions. In addition, remember to submit the new ECS instruction for the new EMI amount.

5. Moreover, if you are planning to obtain a property through a home loan, then wait for some more time as the home loan interest rates may moderate even more in this year 2021. It may fall below 10%.

6. At present, don’t go forward to switch to a different lender or switch to a different home loan plan with the same lender. It may be just a starting of falling the interest rate phase.

7. A home loan EMI has two mechanisms including the interest and principal. The interest mechanism is greater in the early years, so a minor change in the interest rate can have a big influence. Moreover, as the loan period develops the principal mechanism increases. So, when the principal becomes higher, swapping to a lower rate has negligible influence.

8. If you are having a fixed rate home loan over 13% or so, it would be acceptable to change to a floating rate loan.

Here are the existing and new interest rates of home loans with an example.

Furthermore, unlike home loans which have floating rates, most auto loans have a fixed rates. Ultimately, present customers are unlikely to benefit from falling interest rates.

However, the new buyers can profit from lower rates over five or seven-year tenure. In addition, the other kind of loans and small ticket size loans for consumers will fall down as the banks begin reducing the base rates.

Related Post:-

- Funding for Startups from Govt of India

- Top 10 Small Business Starts with an Investment of Rs.10000

- Top 7 Best Unique Online Business Ideas

- Cheap Business Loan For Women & Dalit

- Top 10 Best Small Business Ideas In Hyderabad